Contents

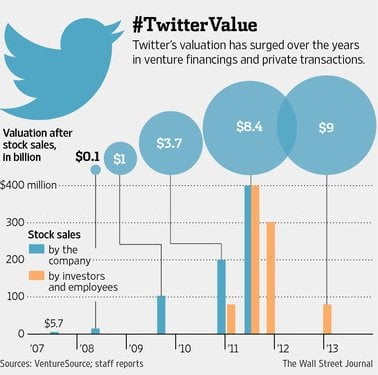

What Is the Market Value of Twitter?

Twitter, Inc. is a San Francisco-based American communications company that operates the microblogging service Twitter. The company previously operated Vine, a short-video app, and Periscope, a live-streaming service. In 2014, Twitter reached $1.3 billion in market value, putting it among the most valuable companies in the world. Its shares have soared to record-high levels in recent months, with the company reporting record quarterly earnings.

Price per share

As of writing, the price per share of Twitter is hovering around $40. It’s worth noting that while some brokers allow you to buy fractional shares, others don’t. If you don’t want to buy whole shares, you’ll need to spread your investment dollars across several different companies. Read also : How to Share a Tweet on Twitter. Here are some things to consider before investing. The price per share of Twitter is expected to decrease this week. This is because Twitter’s shares have already been down over 50% this year, so you’ll need to keep that in mind.

Market capitalization

If you’ve been following Twitter, you’ve probably been wondering about the company’s market cap. This company is an American communications company based in San Francisco, California that operates the microblogging service Twitter. To see also : How Do I Close a Twitter Account?. It also operates other services, including Vine, a short video app, and the Periscope livestreaming service. Twitter’s market capitalization is calculated as of February 5, 2019.

Book value

The book value of Twitter (TWTR) represents the equity available to shareholders on a per-share basis. As of the last financial year, it was $9.73. That value is expected to increase in the next few years, as the company’s growth prospects remain strong. On the same subject : How Do I Advertise on Twitter For Free?. While Twitter has a long way to go, its recent performance has contributed to the stock’s rising value. The following article will outline some key elements that will help investors make informed decisions when investing in the company.

PE Ratio

The current price-to-earnings ratio (P/E) of Twitter is 122. At the end of 2021, the P/E ratio was -160. A low positive P/E ratio means a company is undervalued while a high negative P/E indicates that the company is losing money. As with any valuation ratio, there is a “right” and a “wrong” way to look at Twitter’s P/E ratio.

Earnings per share

While there is no specific method to calculate earnings per share, it is possible to determine it with a few simple calculations. First, we need to translate Twitter’s revenue. Twitter’s revenue is translated on a constant currency basis for its fiscal quarter ended June 30, 2022, using the average monthly exchange rates for the previous year. Because Twitter settles transactions in currencies other than the US dollar, the results will be translated as if the revenue had been reported in the same quarter last year.

Liquidity

The liquidity of Twitter, Inc. has improved over the past quarter. The company’s current ratio is calculated as the current assets divided by the current liabilities. The ratio increased from 6.58 in the third quarter of 2021 to 7.15 in the third quarter of 2022. The current ratio shows the company’s ability to meet short-term obligations. Twitter is currently ranked at a 6.58 current ratio. The short-term liquidity of the company has improved, but it remains below that of the top public companies.

Solvency

If you’re worried about Twitter’s financial stability, you might want to check its solvency ratio. Solvency ratio is a company’s ability to pay debt and interest. A higher Solvency Score means the company is more financially stable. Its cash and investments are higher than its liabilities, a sign of greater financial stability. Twitter Inc.’s debt to capital ratio was 50.9% in Q4 2021 and 50.5% in Q1 2022, however, still suggests that the company has more debt than it is capitalized.

Growth potential

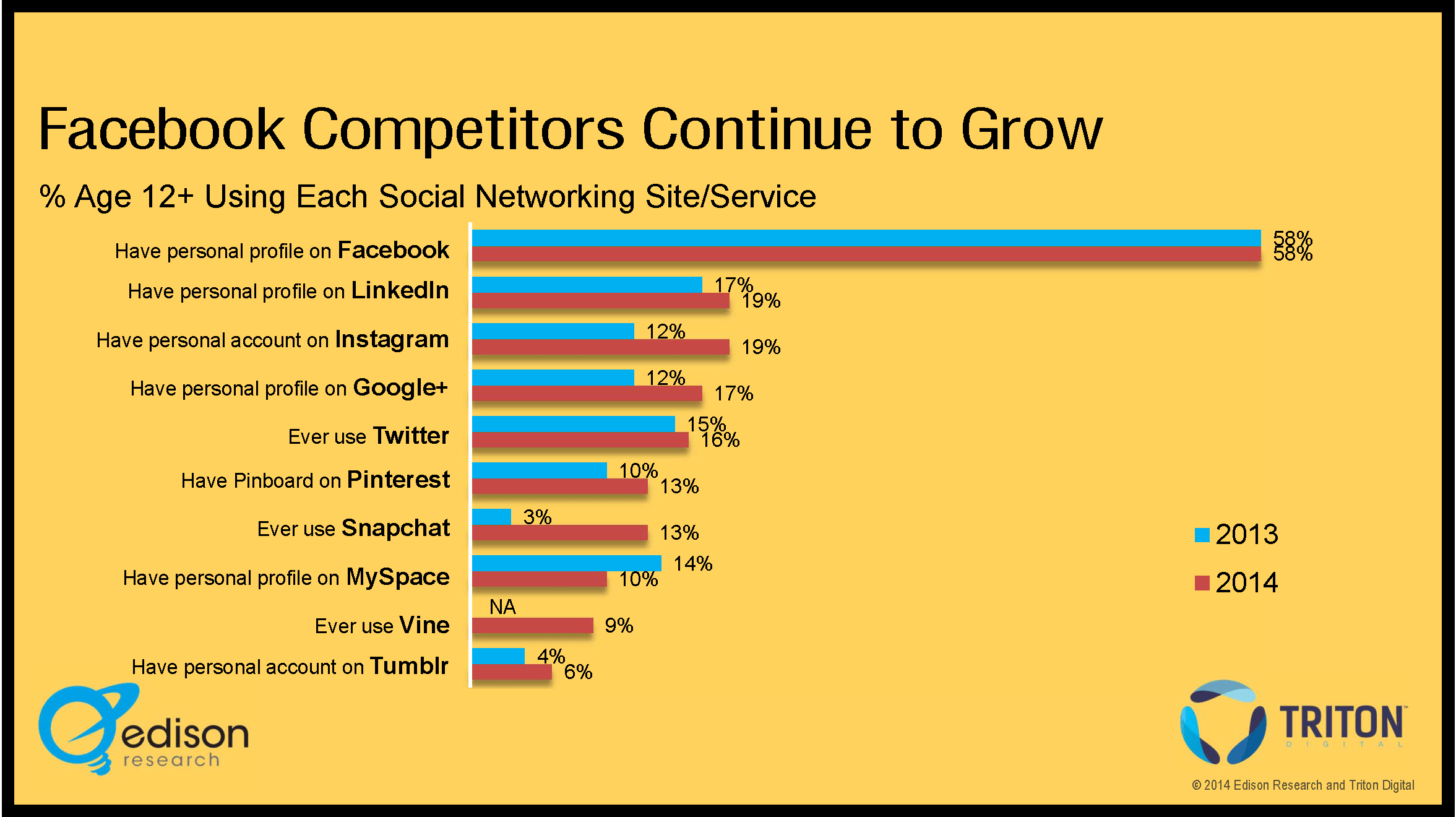

With 192 million monthly active users, Twitter’s growth has been slow in recent years, but this could be changing. Former US President Donald Trump is a frequent user of Twitter, which is thought to have contributed to its popularity and increased usage. But new markets have brought about a surge in usage and engagement. Twitter recently announced a 74% increase in mDAU in India. And while the company continues to grow, it must continue to find ways to increase user engagement and revenue.

Financial leverage

The debt to equity ratio of Twitter Inc. was 0.89 for the three months ending March 31, 2022. As of the end of March, the company’s debt to equity ratio was less than its competitors. Despite this, the debt-to-equity ratio is higher than the industry average of 0.49. Financial leverage is a critical measure of a company’s risk and financial flexibility. To determine if Twitter Inc. is highly leveraged, consider its debt-to-equity ratio.