Contents

How Much Is Twitter Stock Worth?

How much is Twitter stock? Here are some answers to the question: How much is Twitter stock worth? Learn about the P/E ratio and Earnings per share, as well as the tax implications of selling your twitter stock. Also, read about the company’s history and how much money it’s made. If you like what you read, you may want to purchase more of this stock. Besides being a great investment, Twitter stock is a great way to stay connected with the world.

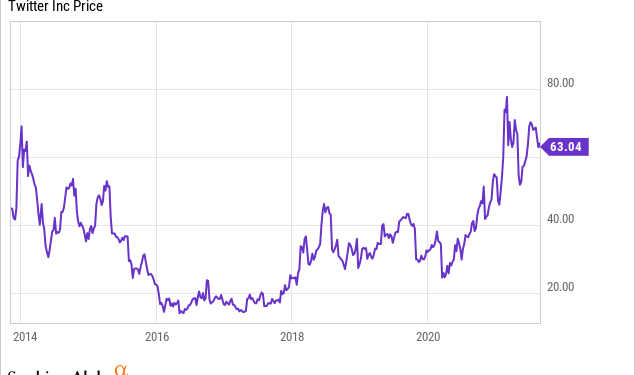

Price of twitter stock

In the last few years, the price of Twitter stock has fluctuated greatly. But what exactly is Twitter, Inc.? The company is an American communications company based in San Francisco, California that operates the microblogging and social networking service Twitter. See the article : How to Gain Followers on Twitter. Its products include Vine, a short video application, and Periscope, a livestreaming service. Its shares have grown by tenfold since its founding in 2006.

As of this writing, the share price of Twitter is around $40 per share. However, some brokers allow you to invest fractional shares, while others do not. Even so, investing in whole shares is a good idea, because it will spread your investment dollars among several different companies. So, when it comes to Twitter, there are many different ways to invest your money in this stock. Here are some ways to choose a broker and get started:

Earnings per share

The first quarter results of Twitter, Inc. were released on Thursday and beat the consensus analyst estimate by a penny. The company reported adjusted earnings per share of $0.77, a significant increase from the previous quarter’s 8 cents per share. This may interest you : How to Change My Twitter Handle. The company reported revenue of $1.2 billion and daily active users of 229 million, compared to analyst estimates of 227.9 million. Earnings per share (EPS) is the company’s revenue minus expenses related to employee stock options.

One thing to note is that Twitter overcounted some accounts from Q1 2019 through Q4 2021. The company reported between 1.4 million and 1.9 million more mDAUs in each of these quarters. This may have been due to a new feature introduced by Twitter to let users switch between accounts. Linked accounts were counted as mDAUs each time a primary account made an action on its linked accounts. Some analysts speculated that Twitter wanted to complete the deal before reporting its earnings.

P/E ratio

The P/E ratio of Twitter stock indicates that the company will struggle to compete. However, a low P/E could be a symptom of an upsurge in growth. The P/E multiple is affected by the growth rate of the company’s earnings. See the article : How to Embed Video on Twitter. The higher the growth rate, the higher the ‘E’ will become. Likewise, paying a high multiple of earnings will eventually lead to lower multiples. This should result in increased buying interest and a rise in the share price.

Twitter’s 50% growth in EPS was fast and rapid. Although the P/E ratio reflects the company’s market cap, it does not account for cash or debt. Growth investments can improve earnings, but they require spending cash or taking on debt. That’s why the P/E ratio of Twitter stock is so important to investors. Considering these factors before buying a stock, investors can choose a good company to invest in.

Tax implications of selling twitter stock

There are tax implications of selling Twitter stock. This is because you may be liable for both short and long-term capital gains. Therefore, you should consult a tax expert before tendering your shares. Twitter’s shares are currently trading at around $40. If you own fractional shares, you can invest in them. Otherwise, you should spread your investment dollars over many companies. It is best to sell the whole shares when you have accumulated enough equity.

Capital gains taxes are applicable if you sell your shares of Twitter for less than their purchase price. This will cancel out any other capital gains that you may have made. For example, if you sold your shares for $2,000, the loss will erase any other $2,000 gain. However, it is important to note that you can apply your capital losses to up to $3,000 of ordinary income. Therefore, it is advisable to consult a tax professional before selling your shares of Twitter.