Contents

What Is Twitter Stock Price?

If you’ve ever wondered what is Twitter stock price, you’re not alone. It’s a company that’s made its name through micro-blogging and social networking. Twitter is the first and largest micro-blogging service and has been around since 2006. Its other services include Vine, a short video app, and Periscope, a live-streaming service. Its stock price is changing rapidly and you might want to check it out yourself.

P/E ratio

If you’re looking for a good investment opportunity, consider Twitter’s P/E ratio. The current value is 122, and at the end of 2021, it will be -160. On the same subject : What Are the Specs for Twitter Ads?. The P/E ratio measures how much a company’s stock price is worth compared to its earnings per share. A low positive P/E ratio suggests that a company is undervalued, while a high negative P/E ratio indicates that a company is losing money.

The current stock price is 50% below its IPO high, and the stock has been in turmoil since Musk pulled out of the deal. It’s a rumor that this might be the IPO high of this famous stock, but the consensus rating on Wall Street is neutral with room for upside. The market’s implied outlook is positive, and it is tilted toward a positive outcome for Twitter. Elon Musk’s back out of the Twitter deal has caused a 50% share price collapse in the last year, and Twitter has sued to force him to complete the deal.

Among analysts, the current consensus price target is around $50, and the company’s long-term P/E ratio is just a little over one. In addition, the analyst consensus price target suggests that shares will be around that level in five years. However, these numbers are not conclusive because TWTR has high valuation, and the analyst price target spread is large. That’s why I would recommend caution in TWTR stock.

PEG ratio

The “Price/Earnings-to-Growth” (PEG) ratio of Twitter’s stock price is the ratio of the company’s share price to its growth in earnings per share. Generally, a low P/E ratio means that the company is undervalued, while a high one indicates that it is losing money. On the same subject : Why is Jake Gyllenhaal Trending on Twitter?. Therefore, you should consider the PEG ratio of Twitter stock price in light of its historical data.

However, PEG ratios have a problem. They are difficult to use because growth rates are not always known. Also, it is impossible to make apples-to-apples comparisons since growth rates can vary significantly. If Meta, for example, was expected to see an earnings per share decline in this year, then its PEG ratio would be 0.86 over the next three years. While that seems like a good idea, it’s not always a good idea to invest in a company with a low PEG ratio.

Using the PEG ratio to evaluate Twitter stock price can be a very profitable move if you’re in the right industry. Twitter’s stock price is very volatile, but its strong growth has led to a great deal of money making opportunities. By understanding the fundamentals of the company, you’ll be able to better understand how to invest in it. If you’re new to the stock market, it’s a good idea to learn about PEG ratios.

Technical analysis gauge

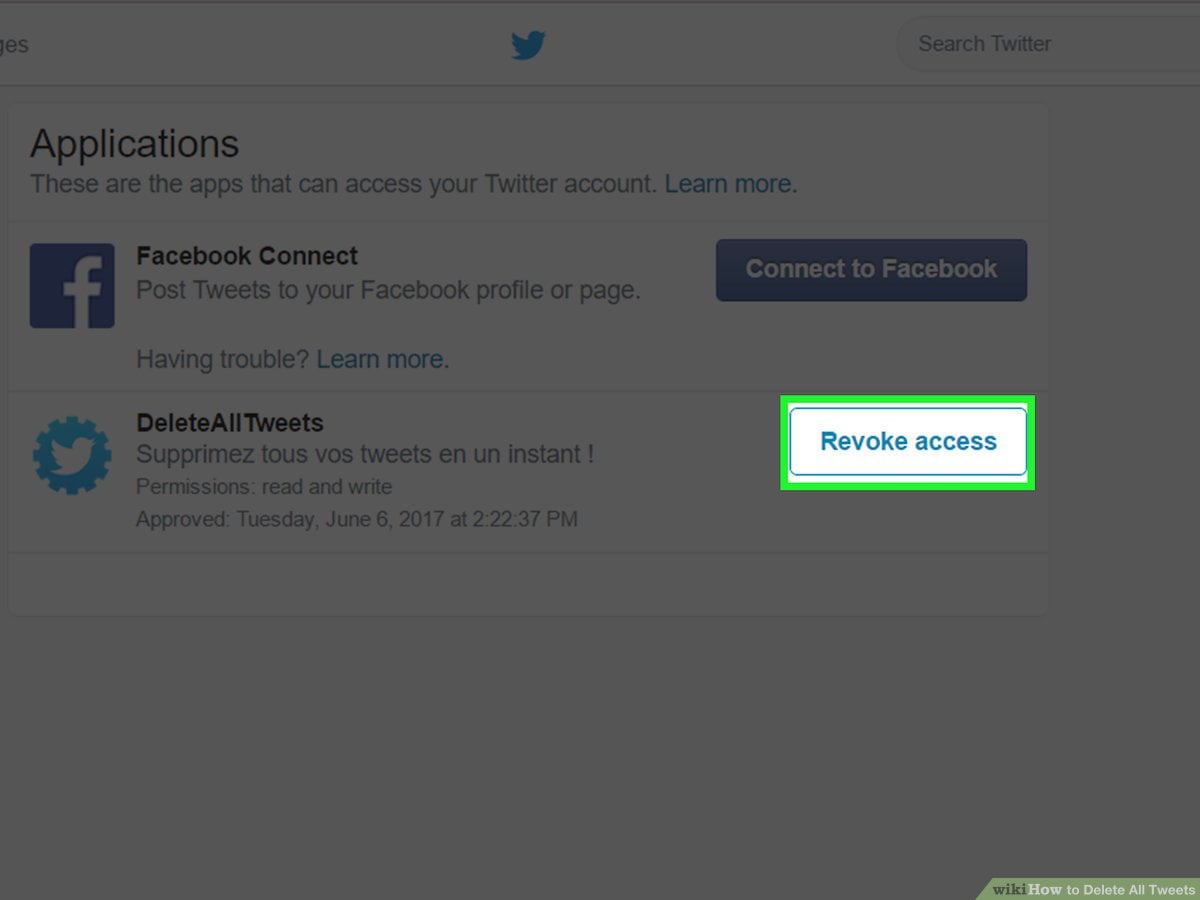

In a down market, Twitter Stock price may rise because buyers perceive the asset to be cheap and are undervaluing the selling price. The daily technical indicators of Twitter stock price help investors determine the level of noise in trading. Intraday price trends are also useful for testing longer-term investment strategies. On the same subject : How to Delete All Tweets in Twitter Using Phone. In the long-term, the stock price of Twitter may continue to trend upward. Nonetheless, traders should be aware of the risks associated with short-term trading.

Most technical analysis for Twitter is designed to help investors determine whether the current trend is likely to continue or shift. The charts provide buy and sell signals as well as various momentum and cycle indicators. In addition, investors can look for events such as breakdowns, which can indicate entry points. If you’re shorting Twitter, a breakout could be a good time to enter the market. In addition, traders can track Twitter sentiment and trend with these indicators.

The ADX buy sell signal for Twitter stock price indicates that the company is bullish and that the buyers are very bullish. If the MACD line is moving upward, then the stock is in an uptrend. Conversely, if the MACD line is moving downward, it indicates that buyers are losing momentum and the stock is weakening. Despite the weakening SELL signal, the MACD line indicates that the stock is still buying momentum.