Contents

Why Twitter Stock Is Slumping Today

Elon Musk and Twitter‘s planned takeover deal are now in doubt, but what really happened? Why did the stock fall today? We’ve discussed the controversy surrounding Musk’s desire to protect free speech and the need to verify spam account figures, but what happened to the Market today? Here’s what you need to know about the latest developments. Read on for a look at the main reasons why Twitter is slumping today.

Elon Musk’s deal to buy twitter is in jeopardy

In the wake of a scandal involving the millions of spam accounts on Twitter, Elon Musk’s deal to purchase the social media site may be at risk. While the company insists the number of spam accounts is a small fraction of their total user base, Musk’s team is expected to take drastic action to remedy the situation. To see also : How Do I Download a Private Video From Twitter?. A person familiar with the matter told The Washington Post that a change in direction is likely, though they did not specify when. If Musk withdraws from the deal, he will be forced to pay the US$1 billion penalty and face a massive legal battle.

According to the Washington Post, sources within Musk’s camp told the newspaper that Musk’s team has stopped discussions with potential backers after the platform’s spam figures were not verified. Despite this, other investors have pitched in billions of dollars to purchase the social media giant. But there is still one problem: the data from Twitter is not verifiable. The company also denies the claims that it blocks one million spam accounts each day.

Musk’s desire to promote free speech

Elon Musk’s rhetoric on the future of Twitter has raised questions about its approach to censorship, harassment, and misinformation. The company’s position as a privately owned company may be weaker, as Musk is also involved in other industries. See the article : What Is a Twitter Professional Account?. His posture on free speech could affect the company’s platform in foreign markets. Moreover, different definitions of “free speech” may have different implications for different countries.

Elon Musk has recently expressed an interest in purchasing Twitter in order to protect free speech on the site. However, since he has publicly stated that he is aiming to take the company private, he has changed his mind about the acquisition. Twitter is suing Musk to stop his purchase and maintain its independence. However, he may not be able to purchase Twitter, so he should reconsider his position. In the meantime, he should continue to promote free speech on the site.

Musk’s failure to verify spam account figures

Elon Musk has made a bid for Twitter, which could put its $44 billion deal in jeopardy. But his bid will not be complete if the company can’t prove that fewer than five percent of its daily active users are automated spam accounts. This may interest you : How to See Comments on Twitter. Last month, Musk’s team obtained raw data of Twitter’s hundreds of millions of tweets to determine how many of those were spam. But today, the company’s stock price has dipped dramatically.

The issue started to escalate when the tweets about the fake accounts started flying. Musk complained to Twitter that they weren’t checking their spam account figures. He also asked why they weren’t aggressively cutting costs. Eventually, Twitter’s CEO refused to approve any of the company’s retention programs and said they were a “sham” and didn’t know what to do.

Market reaction to Musk’s announcement

The announcement sent shares of Tesla plunging nearly a quarter of a cent. But Musk was trying to attract additional investors for the purchase, which put more pressure on the company’s financing. His advisers said it was not an “impulsive” move, but rather an “about-face” that signals possible buyer’s remorse. Here’s the market’s reaction to Musk’s Twitter post.

While the price of Tesla is still way higher than its previous April 13 closing price, some analysts think that the world’s richest man is about to walk away. If Musk’s announcement on Twitter is a red flag, it may be the last straw that makes Tesla shareholders think he will stay away from the third CEO gig. If Musk is able to convince shareholders that he won’t take on another role as CEO, Tesla shares may bounce higher.

Sources: Morgan Stanley

The material on this site may include forward-looking statements that are subject to risks and uncertainties. While Morgan Stanley believes the information it provides is accurate, it makes no representations as to its completeness or accuracy. Any references to third parties are not endorsements by Morgan Stanley. Furthermore, Morgan Stanley is not responsible for information contained on third-party web sites. The terms of these third-party web sites may differ from those of Morgan Stanley.

Reports: These reports include information obtained from Morgan Stanley, as well as from third-party sources. While Morgan Stanley maintains ownership of the information contained in these documents, it cannot redistribute the information without written permission from the authors. The information presented on this site is for informational purposes only and does not constitute legal, accounting, or tax advice. Sources: Morgan Stanley maintains an order flow that does not fully cover all the factors that can be considered in determining the best execution obligation.

BlackRock

With Twitter and BlackRock stock slumping today, is there a cause for concern? Market volatility this week has been increasing amid concerns about surging inflation and a hawkish Federal Reserve. The Federal Reserve aims to curb soaring inflation by tightening monetary policy, but if inflation is hotter than expected, it could trigger a recession. Consequently, it is prudent to hold onto your stocks during this turbulent time.

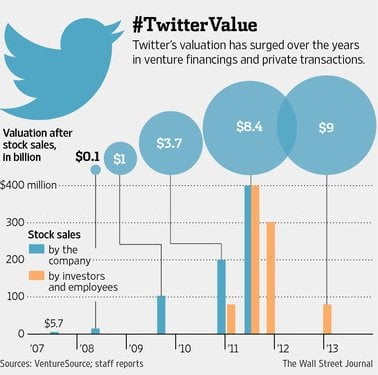

After Elon Musk canceled his plan to buy Twitter, the stock has been under pressure. The news has triggered fears that Twitter’s future is in doubt. The company’s shares closed at a 38% premium to their April 1 closing price. Tesla’s CEO has also disclosed a 9% stake in Twitter. And the market continues to face uncertainty as the company tries to navigate this uncertain situation. While this is a broader economic story, Twitter stock is still under pressure due to Elon Musk’s decision to pull out.