Contents

Is Facebook Stock Still a Good Buy?

If you are considering buying shares of Facebook stock, there are several things to consider. The risks, the potential return on investment, the tax implications, and social commerce are some of the most important considerations. These factors will help you make a decision about whether Facebook is still a good investment. If you are not sure whether Facebook stock is a good buy, read this article. We’ll cover each of these areas in more detail.

Investment risk

When it comes to the investment risk of Facebook stock, you’re better off buying a less volatile stock. This stock already has high volatility, but its beta (or risk) factor is currently 1.39. The more volatile stocks are typically cheaper. However, they’re not the best bets for investors. This may interest you : What Happened to Facebook and WhatsApp?. In fact, Facebook’s beta factor is only 1.39, which doesn’t accurately represent the risk factor. Nevertheless, you should be prepared for volatility, as there are risks associated with every stock.

The latest controversy surrounding Facebook involves the company’s dealings with Russian authorities. The social network sold advertising to the Russian government. After a major investigation, Facebook discovered that the company had invested $80,000 in ads that violated its rules. The scandal caused FB stock to plummet. The next day, Facebook executives apologised and announced modest changes to its policy. Moreover, Zuckerberg said that the company should not be the arbitrator of accuracy.

Return on investment

If you’ve been looking for a way to measure the return on investment of Facebook stock, you’ve come to the right place. A report on the history of FB stock provides a decade’s worth of data. It has a table of contents, which can be used to navigate the report. Read also : How to Block on Facebook. The data is divided by years, and you can view the return on investment for each in a bar graph or table. In addition, the report also includes an annualized value, which shows the annualized returns of Facebook Inc.

The price of Facebook stock fluctuates frequently. To minimize this volatility, buy fractional shares of the stock through brokerages such as Charles Schwab, Fidelity, Stash, and Robinhood. If you’re not sure whether Facebook stock is right for you, consider buying it with a “buy-and-hold” strategy. Of course, you might want to sell it someday, but a “buy-and-hold” strategy may be the best option for you.

Tax implications

In many ways, the tax implications of Facebook stock are unprecedented, not least in the timing and the scale of the whack. The tax whack is particularly jarring because tech companies typically reward employees with stock grants or options. This may interest you : How to Find Out Who Follows Me on Facebook. Facebook, on the other hand, pioneered the practice of awarding employees with restricted stock units. These units do not turn into stock until a “liquidity event.”

As a software engineer, Max, received 100,000 Facebook restricted stock units in 2007 for $1 each. He elected to accelerate his taxable income by making an 83(b) election, which will cause him to recognize $100,000 in taxable income immediately. That’s generally a bad idea, because the employee is essentially paying taxes on their own income. The IRS will tax the appreciation on Facebook stock at the long-term capital gains rate, which is currently 15 percent. The tax bill will be $2 million after the software engineer pays the taxes, which would be $1.67 million less $45,000 tax in 2008.

Social commerce

It’s no secret that Facebook has enormous potential in social commerce. But while it has experienced some minor successes so far, the potential for social commerce is enormous. For example, Facebook just announced that it would allow small businesses to sell products through Instagram and Facebook Shops. With all these positive developments, Facebook stock is still a great buy. Whether it will actually succeed is another story. Here are some of the things to watch out for.

Social commerce is the marriage of ecommerce and social media. These platforms allow people to purchase products or services from brands they already know. According to a recent report by the Harvard Business Review, global ecommerce sales will rise to $1.6 trillion within the next three years, with a nearly 100% growth rate after that. This growth is due to the low barrier to entry. While many analysts are concerned about the economic impact of social commerce, the potential for social commerce makes it a great buy.

Price/earnings ratio

If you’ve been avoiding Facebook stock, you should reconsider your decision. The company’s recent quarter results showed that its profit margin narrowed, and revenue grew at a faster rate than analysts’ expectations. However, while the numbers were impressive, the company’s P/E ratio was still too high. Although Facebook has turned the corner and returned to profitability, its deteriorating P/E ratio has prompted some investors to get out of the stock.

The price/earnings ratio of Facebook stock may seem high compared to other stocks in the tech sector, but it’s actually lower than the S&P 500. The lower P/E ratio means that you’re paying less per dollar of earnings. Although fundamental analysis suggests that Facebook is a good value, remember that it’s important to take a look at the stock’s earnings potential and decide whether it’s worth buying or selling.

Investing in Facebook

If you are considering investing in Facebook stock, the question may be: What is the best way to invest in Facebook stock? There are many different ways to do so, and you should do your due diligence before making a decision. If you don’t understand the metaverse, there are other ways to invest. For example, you could read up on the company’s financials, competition, and stock performance.

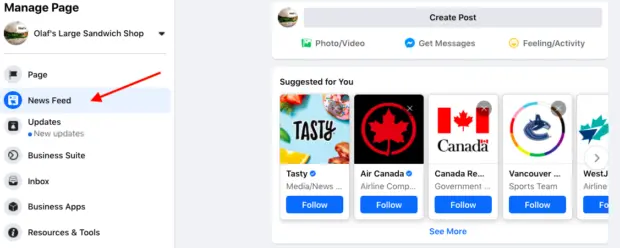

One way to get started is by opening an account with a brokerage firm. This can be done easily online at brokerages such as Robinhood and Charles Schwab. Other popular brokerages allow you to buy fractional shares. If you can’t afford to purchase full shares at once, you can opt for dollar cost averaging. This type of strategy allows you to purchase a certain number of shares every month, reducing your volatility and cost-per-share over time.