Contents

How to Buy Shares in Facebook

There are various ways to invest in Facebook stocks. Some people invest in fractional shares. These investments are called CFDs or contract for difference. This article will give you an overview of how to buy fractional shares of Facebook. You can also invest in Facebook ETFs. If you’re looking for ways to invest in Facebook stock without making a large initial investment, read on. You’ll learn about buying Facebook stock with a fractional share, buying shares with a stock market order, and Investing in Facebook stock market order.

Buying fractional shares

As a new investor, you might not know how many shares of Facebook to buy. This is where buying fractional shares in Facebook can come in handy. The brokerages often offer these shares in traditional share portions. On the same subject : How to Change Facebook to Dark Mode. If you want to buy more than a single share, you can divide your investment into several smaller pieces and invest those monthly. By following these steps, you’ll be able to max out your Roth IRA by 2021.

The price of Facebook stock is extremely high, which makes fractional share investing a great way to invest in the stock. Buying shares in Facebook on eToro, for example, is free. However, if you’re not comfortable with this option, you can also buy shares in other companies with a high economic moat. For example, you could buy fractional shares in Apple or Amazon. Remember that just because a stock is cheap doesn’t mean it’s a good investment. If you’re not comfortable buying fractional shares, learn about stock valuation and then decide if it’s right for you.

Investing in Facebook ETFs

If you are interested in investing in Facebook ETFs, you must open an account with a broker. The process is normally completely online, but some brokers might require you to go through a background check. These brokerage accounts store your shares. On the same subject : How to Unfriend in Facebook – Is it Rude?. You can purchase shares of Facebook with cash through your broker. You should use the advanced order type, which only purchases shares when the price of the stock drops below a set threshold.

In June of last year, Roundhill Ball launched a fund that is based on Facebook, known as “Metaverse.” The company chose the META ticker because it was short and easy to remember. However, it was not yet confirmed whether Facebook wanted to use the ticker. This ETF is not yet listed on the NYSE. Instead, it trades as a global equity security. The fund’s asset value has increased six-fold since the news broke.

Investing in Facebook stock market order

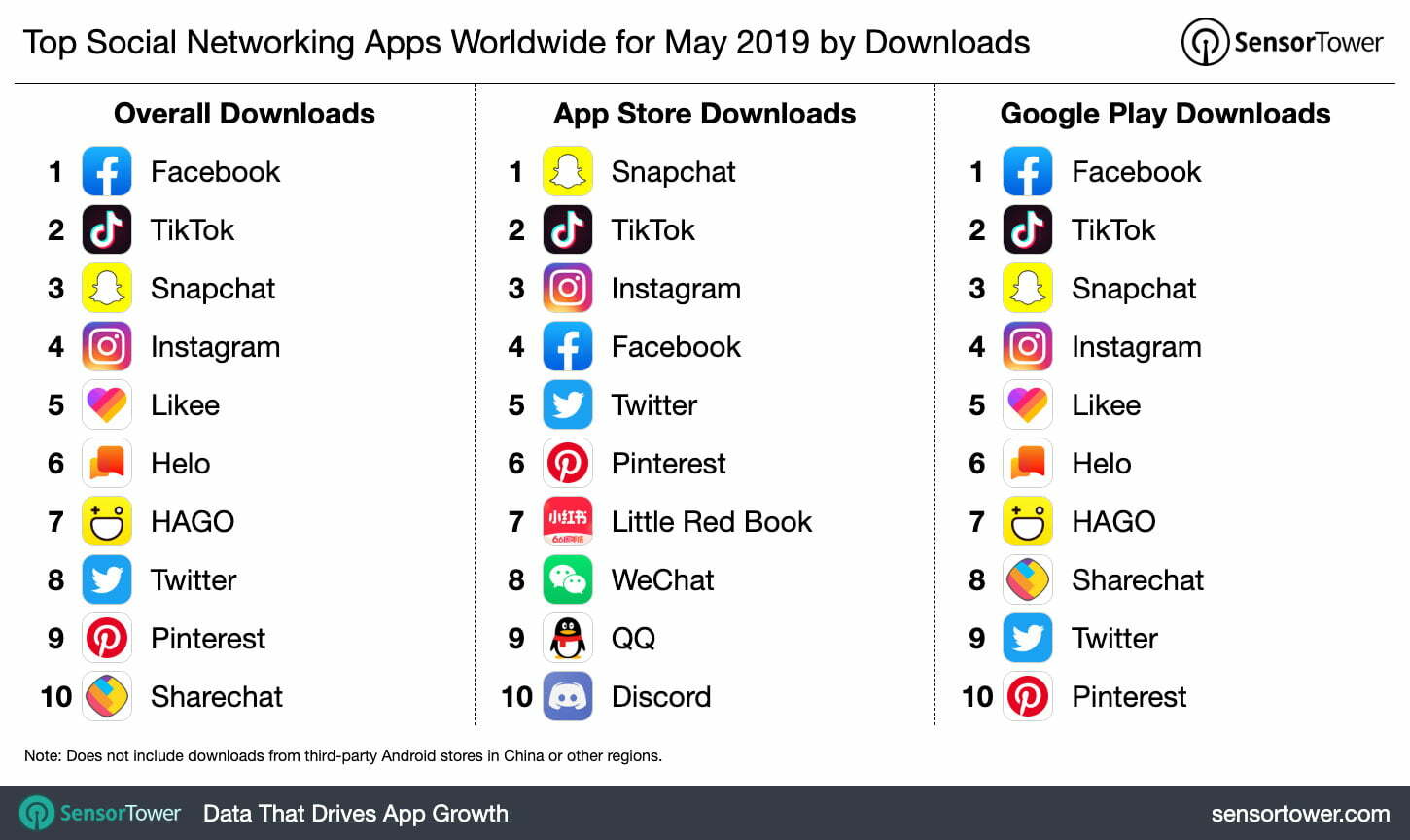

Investing in Facebook stock can be lucrative and rewarding. As the largest social networking website with 2.5 billion monthly users, the company is a major force in Silicon Valley. See the article : How to Deactivate Facebook Messenger. With the help of technology, Facebook is making our lives easier, and you can take advantage of this by purchasing Facebook stock. Here are some of the ways to invest in Facebook stock:

When buying Facebook stock, make sure to choose a broker with a NASDAQ account. Facebook is traded on the NASDAQ under the ticker FB. Make sure to check whether your broker is registered with NASDAQ or NYSE. Many brokers offer free or low-cost trading but be aware that some may be expensive, especially if you are a citizen of another country. Not all brokers are accredited to sell Facebook shares.

Investing in Facebook stock CFDs

You can invest in Facebook stocks CFDs via a broker who has access to the FB stock exchange. When choosing a broker, consider factors like educational materials, research, and account types. If you’re investing for long-term goals, you should look into a tax-advantaged account. Likewise, if you’re investing for shorter-term purposes, look for a taxable investment account.

Unlike traditional stocks, CFDs are risky. You don’t actually own the stock, so you’re simply speculating on the price movement. Trading with CFDs allows you to hedge against other trades, and you can get up and down in price as your goals dictate. In addition, CFDs are a great option for short-term traders. However, it is important to note that trading in Facebook stock CFDs is a risky activity.

Investing in Facebook stock fully online

Before you invest in Facebook stock, you should be sure to do your research. Read annual reports and quarterly earnings reports to get an idea of how the company is faring. Also, attend the annual meeting, which provides important company news. If you are new to investing, it is recommended to stick to a proven investment strategy. In addition, make sure to diversify your portfolio. Investing in Facebook stock fully online may be the best investment for you if you have some prior experience in investing.

After you have chosen a broker, you should deposit a certain amount of money to the account. You can also choose to buy fractional shares of Facebook stock from exchange-traded funds or brokerages such as Charles Schwab. Using exchange-traded funds is a good idea because they pool thousands of stocks and reduce the risk of investing in a single stock. Moreover, these funds also allow you to diversify your portfolio across thousands of companies, which increases the chances of overall growth.

Investing in Facebook stock without a brokerage account

If you’d like to buy shares of Facebook stock, you’ll need a brokerage account. The process is fairly simple, but it’s also important to consider your own financial situation before making a decision. If you plan on investing for long-term gains, you’ll want to consider opening a brokerage account. However, if you’re just starting out, you can purchase individual shares of FB without an account.

To avoid the risks of investing in Facebook, diversify your portfolio. While Facebook shares are extremely volatile, you can diversify your portfolio by purchasing fractional shares from brokerages such as Charles Schwab, Fidelity, Stash, Robinhood, and E*Trade. To reduce volatility and lower your cost-per-share over time, you may want to consider using dollar cost averaging.