Contents

Facebook Stock Price – Can Facebook Stock Hit 1000 Dollars?

Is Facebook a safe long-term investment? The term “social media” will be obsolete in 20-25 years. That said, it is still likely that the stock will reach a price of a thousand dollars by the end of the decade. Facebook trades at a 20-times forward earnings multiple. If you’re interested in investing in the medium-term, Facebook might be a safer option than Apple, which recently surpassed a $650 billion market cap.

Social commerce

While Facebook and other social media platforms like Instagram are making moves to offer shopping capabilities, they are largely focusing on boosting their own stocks. With integration of shopping features, product tagging, and other ecommerce tools, these platforms hope to emulate the success of Chinese and Southeast Asian tech companies. The social media platform Meta Platforms is betting that it can eat into some of that share of ecommerce growth, and this could make it a key player in the social commerce space.

The company is focusing on enabling consumers to complete a transaction with the help of a mobile app, and Shops will make it possible. In addition to providing a seamless shopping experience, Shops will allow merchants to create mini-shops inside of the Facebook and Instagram apps. Read also : How Long Is a Temporary Block on Facebook?. With this, Facebook is poised to become the largest online retail market in the world. However, if the company can continue to build on its Shops, it could be a bonanza for Facebook and its stock.

Strong growth prospects

The share price of Facebook has fallen sharply this year. While the Nasdaq 100 index has shed 22.8%, Facebook stock has slid more than 42 percent in the first six months of 2018. To see also : How to Unpin a Post on Facebook. But this decline is not yet indicative of the company’s future prospects. Here are the reasons for the drop:

Meta Platforms: Another social media giant, Meta is reshaping its business model. However, the stock has plunged over the past year due to a negative tailwind from mass vaccinations and the pandemic. While Meta’s management reassured investors, this downtrend is still premature. This social media stock’s growth prospects remain cloudy, however. Investors are looking for a clear path to growth, so investors are cautiously optimistic.

Low valuation

You may be wondering why Facebook stock is still at such a low valuation. Despite its huge potential and soaring stock price, the social networking giant is trading at just 27 times forward earnings. That’s a cheap valuation considering that consensus analyst forecasts for FB’s earnings per share to increase 29% in the next five years. Read also : How to Change Email in Facebook. However, there are some factors to consider if you want to take advantage of Facebook’s low valuation. Facebook has a strong business momentum and a fortified balance sheet. In addition, analysts believe that Facebook revenue will increase sequentially in Q3 2021 due to a reopening of the economy.

It’s true that the company has lost much of its market capitalization in recent months, but the drop in its stock price is still a major cause for concern. Its latest quarterly report revealed that its daily active users (DAU) are declining at a faster pace than expected. Investors also fear that Facebook’s user base will stagnate in the next few years, which means that the stock could face a severe correction in the near future.

Risks

If you’ve been watching the market, you’ve probably noticed that Facebook has been climbing to higher highs. Although social commerce has become more popular than ever, FB stock still has a significant downside risk. In addition, Facebook’s soaring valuation could be affected by a potential recession, which would compound the slowdown in e-commerce spending. That’s why it’s important to understand the risks of investing in Facebook stock.

The risk of the stock falling significantly is systematic and not particular to Facebook. The 2007-2008 stock market crash had no way of preventing companies tied to finance and housing. In fact, the Nasdaq lost 75% of its value during the dot-com crisis. Those fears are completely unfounded, however, as Facebook has managed to fend off the biggest legal threat. The stock price may fall by as much as 70% before hitting 1000, but if the company continues to grow at its current pace, it may not fall that far.

Return on investment

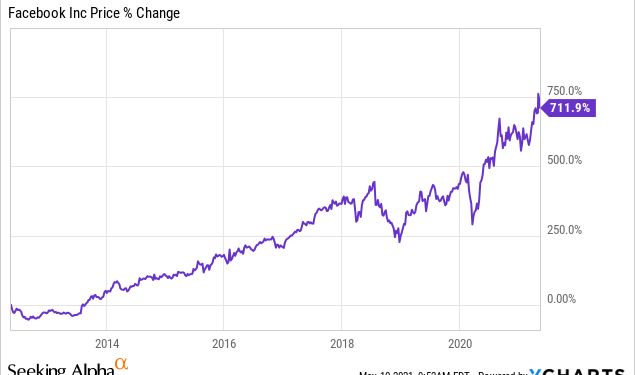

When it comes to return on investment, the social media company, Facebook Inc, ranks fourth among its peers. This stock has exhibited both the best and the worst performance in recent years. Currently, it is still in the top five. However, it is rare for investors to exit their position in a month or two. This is because its P/E ratio is lower than its peers, which means that investors are paying less for each dollar of earnings.

As the stock price of Facebook fluctuates constantly, it can be difficult to predict the return. One way to limit risk is to use fractional shares, which are available from some brokerages. A few of these brokerages are Robinhood, Stash, and Charles Schwab. Another strategy is to use dollar cost averaging, in which you purchase shares of the stock on a regular basis. By doing this, you will decrease the risk of price volatility and cost per share over time.