Contents

What Happens to My Twitter Stock?

Twitter shares were trading on the New York Stock Exchange (NYSE) today, but they fell nearly four percent in after-market trade after Elon Musk’s bid to buy the social networking giant. The company changed hands for $37 a share, a price that indicates investors do not expect the acquisition to close. This would likely result in a lower price tag, but the timing was also poor considering the recent market drop. In the meantime, Twitter shares will continue to be traded in the open market, but they may be trading on a NASDAQ-like exchange.

Shares of Twitter are still trading on the New York Stock Exchange (NYSE)

You’ve probably wondered whether you can still buy shares of Twitter, Inc., even though Elon Musk has been involved in the company’s recent drama. This may interest you : Why is Chris Chansonichu Trending on Twitter?. Musk has a 9.2% stake in Twitter and joined the company’s board, but then reversed course a few days later. Musk then announced that he was buying Twitter and will be taking his company private, but not before dumping a lot of Tesla stock in the process.

You can purchase shares of Twitter by following these five steps. First, open an account with a brokerage and use the ticker symbol TWTR to purchase shares of Twitter. Next, enter the dollar value of each share and how many shares you’d like to purchase. Some brokers offer fractional shares; others only offer whole shares. To make the best investment decisions, diversify your investment dollars among several companies.

Elon Musk’s bid to buy Twitter could result in a breakup fee of $1 billion

Twitter may be preparing to fight off Elon Musk’s $44 billion bid for the social media giant, and the company could push for a $1 billion breakup fee if the deal goes through. Twitter could have walked away after all, but the company’s board is sticking by its decision. Elon Musk isn’t the first billionaire to pull out of an acquisition deal. He has already pulled out of Facebook‘s purchase of Snap, and he’s already sent a letter to the board of directors of Twitter. But Twitter hasn’t responded to a message for comment. And it’s not clear if the company will accept a $1 billion breakup fee, or if it will go to court over the deal.

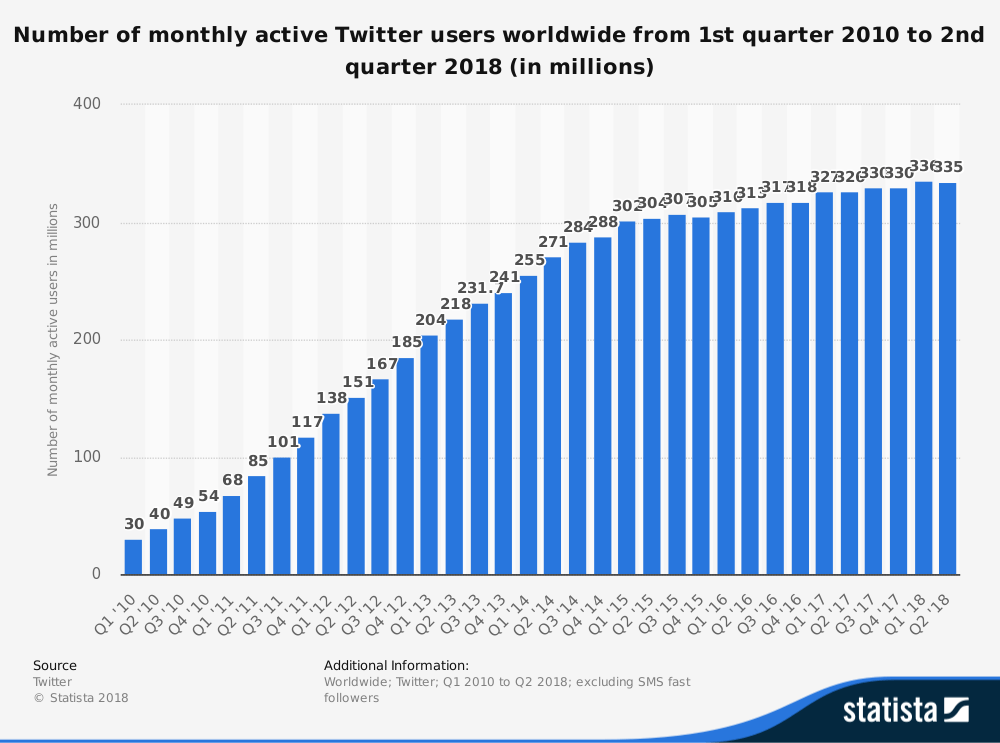

A breakup fee of $1 billion would be high if Musk’s bid for Twitter doesn’t get through. If he loses in court, the loss could far outweigh the $1 billion breakup fee. See the article : How Many Users Are on Twitter?. Not only would Musk have to pay a breakup fee, but he would also have to face the reputational damage of breaking up with the company. This would mean future companies might be leery of buying the company from him.

How to buy twitter stock before it becomes a private corporation

You can buy Twitter stock before it becomes a private corporation. You will need to open an account with a brokerage firm. Normally, you can open an account quickly and easily. This may interest you : How to Find Out Who Blocked Me on Twitter. You will need to link your checking account to the brokerage firm. Once you have an account, you can search for tweets with the ticker symbol $TWTR. Once you have found the shares you like, you can purchase them.

In order to buy Twitter stock before it becomes a private corporation, you need to have a plan in place. Twitter’s future is uncertain because it is owned by Elon Musk. If the company goes private, shareholders will receive a payout for their equities. You can use this money to pay off debt or invest in retirement. If you’re lucky enough to buy Twitter stock before it goes private, you’ll be able to profit from the opportunity.

How to monitor Twitter stock’s performance

As a Twitter stock holder, you may be wondering how to monitor its performance. There are a couple of things that you can do. For one, you can look at the company’s beta, which measures how volatile the stock is compared to the market average. For example, the beta for Twitter is 0.5947, which means that it is less volatile than the market average. Moreover, you can compare the company’s beta to the major indices like the S&P 500 and the Dow Jones Industrial Average to see how well Twitter stock is doing.

The next thing you can do is set up an alert on your phone for a specific hashtag or stock. This will help you stay updated when a certain stock’s price changes. You can even subscribe to geotargeted twitter stock alerts. You can receive these updates on a weekly, monthly, or daily basis. For added convenience, you can even set alerts in real-time, so you don’t have to spend time hunting for updates.