Contents

What Day Does Facebook Report Earnings?

When does Facebook report earnings? The company’s earnings reports are released on a quarterly basis. The first quarter results are always highly anticipated. Earlier this year, Meta’s stock plummeted more than 25 percent following the release of its earnings report, while Facebook’s user growth dipped. Despite the bleak numbers, investors still seem excited. Here are five things to know about the company’s earnings report.

Meta’s quarterly earnings report

Today, the company that owns Facebook, Instagram, and WhatsApp, Meta Platforms, Inc., filed its quarterly earnings report. The company is based in Menlo Park, California. Its revenue last year increased by a whopping 200%. It is expected that this growth will continue throughout the rest of 2016.

This year’s results will be interesting for investors. While analysts expect Meta’s quarterly earnings to grow a little less than expected, investors should be encouraged by its Q1 FY 2022 revenue guidance. Even though it has lowered its guidance, investors should still consider the company’s strong cash flow. To see also : How to Change Your Birthday on Facebook. The company expects to remain the largest social network in the U.S. while still generating a huge amount of free cash flow every quarter.

Facebook’s quarterly earnings report

What’s up with Facebook on earnings report day? This year, the company has been under the spotlight for a number of reasons, and today, it’s no different. The company, formerly known as TheFacebook, Inc., is an Internet giant headquartered in Menlo Park, California. This may interest you : How Can I Contact Facebook?. Its main products include Facebook, Instagram, WhatsApp, and Messenger. Its quarterly earnings report is scheduled to be released on August 20.

While the stock is down in 2018, Facebook’s user base is still massive, with half the world using its mobile app monthly. While competition is stiff, growth in monthly active users has slowed. Some analysts believe Facebook is still suffering from the COVID-19 hangover. Facebook’s CEO, Mark Zuckerberg, has said that the company plans to invest $10 billion by 2021 in its Reality Labs division, which focuses on virtual reality, augmented reality, and the “metaverse.” In spite of this, however, the division has already reported a fourth-quarter loss.

Meta’s stock plunges more than 25 percent

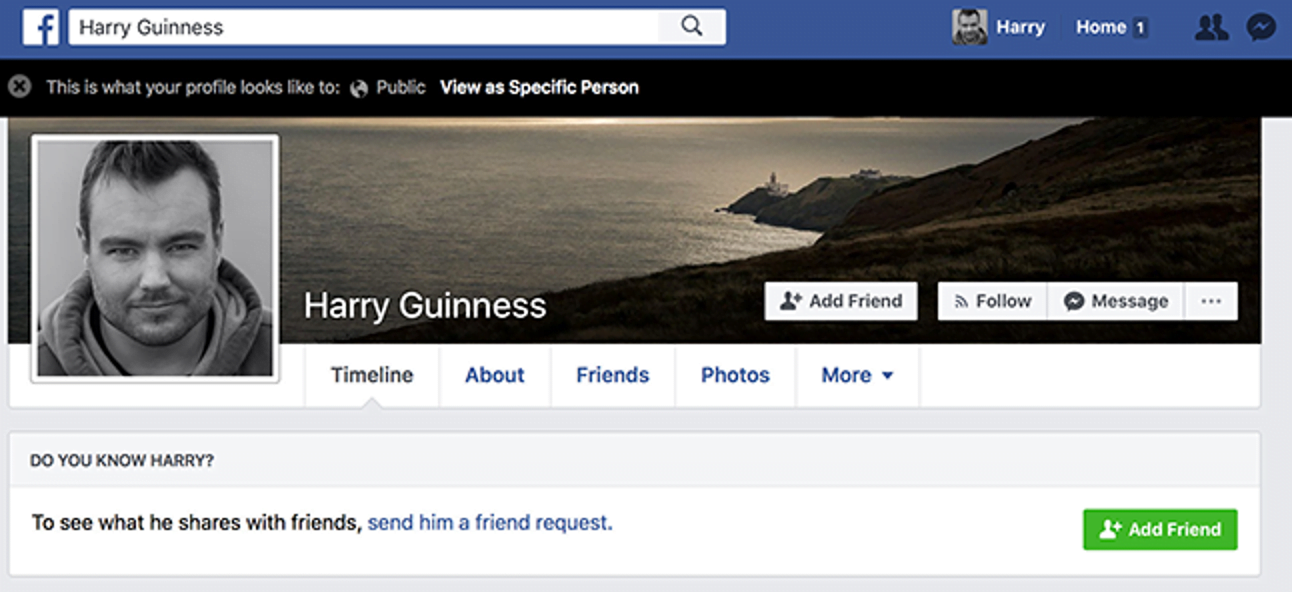

After reporting disappointing Q4 earnings, Meta’s stock has dropped over 25 percent, the most in the company’s history. The plunge was the company’s biggest one-day loss in stock market history. In the quarter, Meta added only 2 million new monthly active users, down from 15 million in the prior quarter. To see also : How to Make Facebook Account – Create a Personal Profile and Customise Your Privacy Settings. The company missed analysts’ profit estimates by 14 cents, resulting in the stock’s steep plunge. The fall is a stark contrast from the 19 percent decline Meta experienced back in July 2018.

Meta’s stock price plunge was part of the broader market’s slump. The tech-heavy Nasdaq fell more than three percent on Thursday, while Snap and Spotify dropped almost as much. The Nasdaq’s decline was driven by disappointing Q4 results for the two companies. The drop in Meta’s stock came after its Q4 earnings report lacked guidance.

Facebook’s user growth declines

Despite being a highly popular social network, Facebook’s total user growth is declining for the first time in its history. The company’s growth was seemingly never-ending over the last 17 years, but it has now started to slow down in the United States and Canada. According to ComScore and Nielsen, daily user growth is down, a trend that could be caused by a number of factors.

The first quarter’s earnings report for Facebook showed that its daily user growth had declined for the first time ever. In the fourth quarter, Facebook lost half a million users. With more than 1.9 billion active users, that represents a 7% decline. In addition, Facebook’s daily user growth declined at a faster pace than it had in the prior quarter. That means the social network has reached its saturation point globally.

Facebook’s revenue growth slowest on record

Facebook’s revenue growth is slowest on record. The social network has said that it is facing slowdown due to various internal and external factors, such as the Russian invasion of Ukraine. Facebook’s stock price is also down by more than half this year, after losing more than 50% of its value in February and March alone. After this earnings report, many analysts predicted that Facebook’s revenue would rebound in the second half of the year.

In addition to a slowing revenue growth, Facebook’s newest ambition is virtual reality hardware. Despite spending $10 billion to develop the hardware for its “metaverse” product suite, the company reported a loss. Even though this division is still in its early stages, it is not expected to make a profit until 2021. This is a sign that Facebook may need to slow the pace of some investments to boost profits.

Facebook’s guidance weaker than expected

The company said it had higher expenses in the second half of the year, but it still expects to generate $25 billion in operating income this year, beating the $23.7 billion it produced in the first half. It attributed its disappointing guidance to two factors: the slowdown in China and a cash-heavy consumer. Despite these issues, the company said it was confident that its business will continue to grow, despite a slowdown in revenue growth.

Despite lower guidance, Meta Platforms’ Q4 results were in line with analyst expectations. Revenue for the fourth quarter of FY2021 rose 19.9% year on year to $33.6 billion. Meta provided disappointing guidance that reflected weak revenue growth. Its shares tumbled 26 per cent to $238 on Thursday, versus $320 when the markets closed on Wednesday. The slide knocked $200 billion off the company’s market cap.