Contents

How to Get Rid of a Facebook Charge on My Credit Card

One way to get rid of a charge is to use a prepaid card. These are better for one-time transactions on unreliable sites like Facebook, since they are usually canceled after one use. In addition, these cards usually come with preset spending limits. You can also fill out a dispute form on Facebook, but this won’t help you much. It’s better to report unauthorized charges to your bank and credit card company, since they can then take action.

Messages service

Have you noticed a mysterious Messages service charge on your credit card? This may occur as a result of your Facebook ads account being leaked, or it could simply be that your card was added to an ad account. If this happens, contact your bank or credit card issuer to dispute the charges. On the same subject : My Facebook Account Has Been Hacked – How to Recover. You may also have to supply some transaction information. If all else fails, you can contact Facebook to find out how you can dispute these charges.

Although Facebook has yet to release a specific number of users who use its messaging service, it’s worth noting that it processes more than a million payments per day. Moreover, the payment system is completely separate from the rest of Facebook’s network, so it receives additional monitoring and control. Nevertheless, the new fees are still a bit arbitrary, so if you don’t find it acceptable, don’t use it.

Ad spend

If you’ve ever wondered how Facebook charges your credit card for your ad spend, you’re not alone. Thousands of Facebook users have experienced the same issue. But there’s some good news. Read also : What Is a Facebook Page For a Business?. Facebook makes it easy to cancel your ads, as long as you’ve followed a few simple steps. You can also request a refund if you overspend your budget. Here’s how.

You may have accidentally paid for your ad spend. Luckily, Facebook is able to refund this amount. If you don’t remember setting your budget before you started using Facebook, you can file a payments support request to request a refund. However, Facebook does not automatically apply your credit to your ad spend – you have to add it yourself. If you’ve accidentally paid for your ads, you should request a refund, as the process is very simple.

Surprise party

A 15-year-old girl has accumulated $6,500 in charges in a couple weeks, while a young boy in Arizona spent over a thousand dollars in a weekend. Meanwhile, a young mother in Arizona just discovered her toddler had spent $250 on Facebook games. On the same subject : Who is the Real Founder of Facebook?. Outraged parents contacted their credit card companies and filed chargebacks against Facebook, triggering the social networking site to claw back the money from the users. Facebook has seen its chargeback rate increase, and many parents are turning to their credit card companies to get the money back from its games.

Messages service’s privacy policy

Facebook started the year with a reputation as a caring company, but it’s ending it on a money-making note. The company is revamping its popular Messages service, which allows you to send messages to people who aren’t Facebook friends. The change, described by Facebook as a “small experiment,” will charge users $1 for every message they send to people who aren’t their friends.

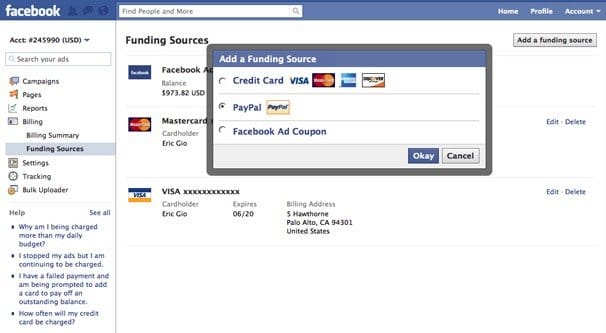

Facebook’s new system for charging credit cards

If you notice charges on your credit card from Facebook without authorisation, you can dispute the charges. These charges are temporary and automatically removed from your credit or debit card statement. If you do not see a Facebook charge on your statement, contact your card issuing bank to dispute the charge. Facebook’s website provides a form to dispute these charges. You may be required to submit transaction details before requesting a refund.

To use Facebook Pay, you must have a credit card with the CVV code on the front and back. Facebook does not allow users to pay with different credit cards at the same time. Make sure to read your card’s terms and conditions before confirming a payment. You should also check your card’s credit limit. If you do not have enough available credit on your account, you can decrease the threshold. Check expiration dates, as well.